Excitement About Hard Money Georgia

Wiki Article

Fascination About Hard Money Georgia

Table of ContentsWhat Does Hard Money Georgia Do?6 Simple Techniques For Hard Money GeorgiaSome Of Hard Money GeorgiaHard Money Georgia Can Be Fun For AnyoneThe 2-Minute Rule for Hard Money Georgia

The bigger deposit need mirrors the boosted difficulty in selling a business residential property, as there are far fewer customers for industrial residential or commercial properties compared to homes. If a consumer defaults on an industrial difficult money funding and also the residential property is taken back by the tough cash loan provider, the list price might need to be discounted considerably so the lender can recoup their financial investment with a quick sale.If you're looking to purchase a home to flip or as a rental building, it can be testing to obtain a traditional home loan. If your credit rating isn't where a typical lending institution would certainly like it or you need cash money quicker than a lending institution is able to provide it, you could be out of luck.

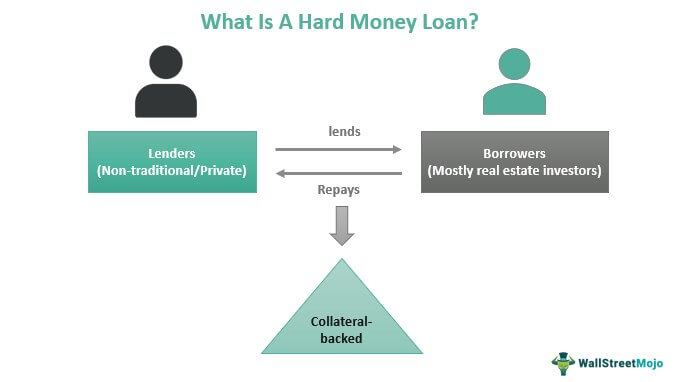

Difficult cash loans are temporary safe car loans that make use of the home you're purchasing as collateral. You will not locate one from your financial institution: Tough money car loans are supplied by different lending institutions such as specific investors as well as private firms, that generally neglect mediocre credit history ratings and other financial elements and instead base their decision on the residential property to be collateralized.

The Best Guide To Hard Money Georgia

Difficult money lendings provide several advantages for debtors. These consist of: From beginning to finish, a tough cash car loan may take just a few days - hard money georgia.While hard cash car loans come with advantages, a debtor should likewise take into consideration the risks. Among them are: Difficult cash lending institutions generally bill a greater passion rate because they're presuming more danger than a traditional lending institution would.

All of that amounts to indicate that a tough cash car loan can be a costly method to borrow cash. Deciding whether to get a difficult money financing depends in large component on your situation. All the same, make sure you evaluate the dangers as well as the expenses before you authorize on the populated line for a tough cash financing.

Hard Money Georgia Things To Know Before You Get This

:max_bytes(150000):strip_icc()/GettyImages-1137516784-604537c07dad40eea021db81f5527ecf.jpg)

You're uncertain whether you can afford to pay off the hard cash lending in a short time period. You have actually got a solid credit report as well as should have the ability to qualify for a traditional lending that most likely carries a lower rates of interest. Alternatives to difficult money fundings consist of conventional mortgages, house equity fundings, friends-and-family financings or financing from the residential or commercial property's seller.

It is essential to take right into account aspects such as the lending institution's online reputation and also rate of interest. You could ask a trusted realty agent or a fellow house flipper for recommendations. As soon as you've pin down the ideal hard money loan provider, be prepared to: Come up with the down settlement, which normally is heftier than the down payment for a conventional home loan Collect the necessary documents, such as evidence of income Possibly hire a lawyer to review the regards to the financing after you've been accepted Map link out a strategy for repaying the car loan Simply as with any why not check here kind of funding, evaluate the pros and also disadvantages of a tough money funding prior to you devote to loaning.

The Only Guide for Hard Money Georgia

Despite what kind of lending you select, it's possibly an excellent concept to examine your free credit report and complimentary credit rating report with Experian to see where your funds stand.

The distinction in between difficult money and also private cash is not that clear. What is the difference between tough cash and also personal cash? And which lending institution should you go with?

Hard Money Georgia Fundamentals Explained

This advantages investor in a couple of means: as you do not need to jump with as numerous hoops to obtain exclusive or difficult cash, you can occasionally have your lending accepted in less than a week. With traditional funding, your credit rating has to satisfy particular requirements. That's not the case with difficult and private loan providers.This additionally helps you spread out the threat instead of taking it all upon yourself. Exclusive lenders can be really innovative with offering terms, whereas difficult cash finances do not have any kind of early repayment charge. These are just a pair of methods in which these two loans are extra versatile than going down the typical financing course.

Actually, if they follow all the click to read borrowing laws, any person with additional cash or an invested rate of interest in your property financial investment could be generated as an exclusive money lender. Similar to hard money financings, the funds debtors receive from an exclusive lender normally go towards the purchase rate and improvement of a building.

Report this wiki page