Discover how Cash Loans can resolve your immediate financial gaps

Wiki Article

How Pupil Finances Help Forming Your Future: Trick Insights and Solutions

Pupil fundings act as a necessary mechanism for accessing college, which can significantly boost occupation possibilities. These fundings come with financial ramifications that can affect life choices. Understanding the different funding kinds and their impact is vital. As people browse this facility landscape, they have to take into consideration effective methods for managing debt. What resources and insights can aid them attain financial security while seeking their goals?Recognizing Pupil Fundings: Types and Terms

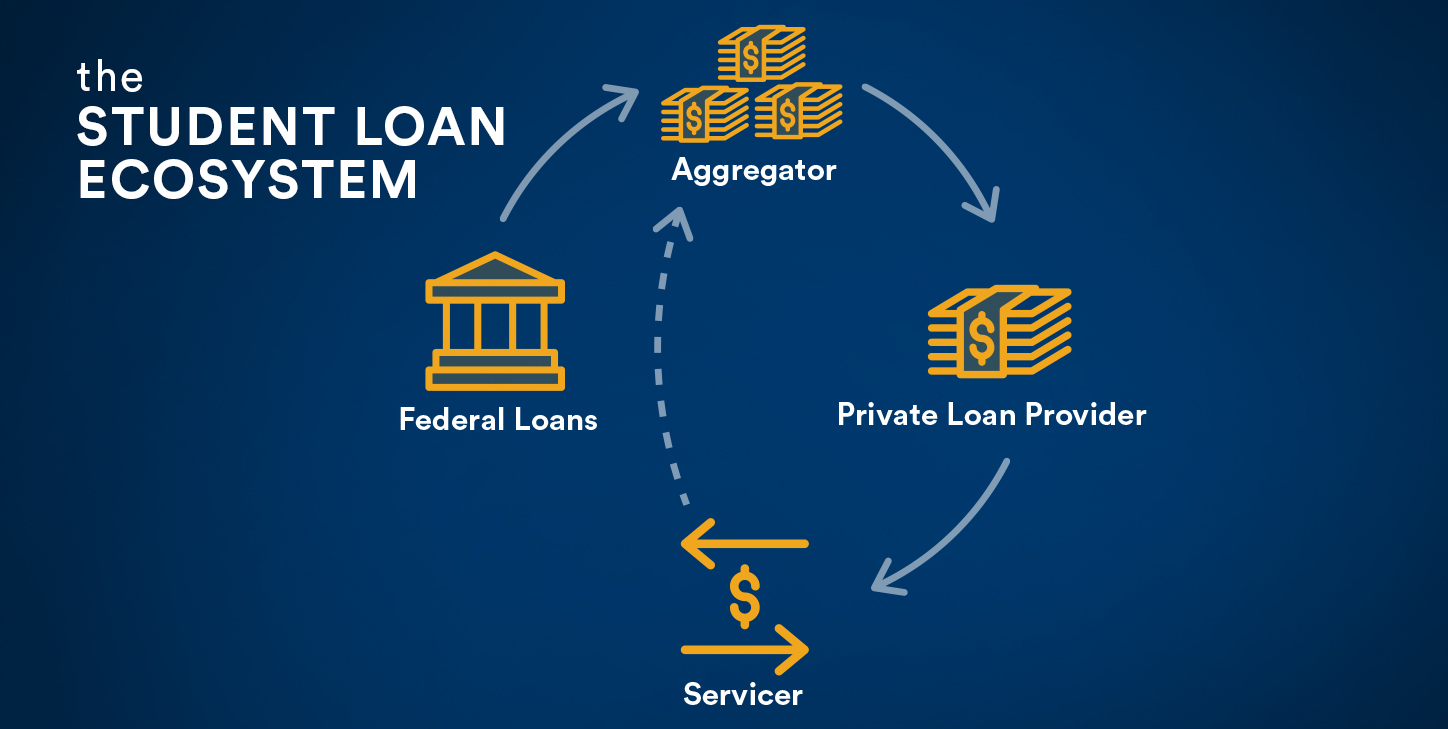

While numerous students think about pursuing higher education and learning, recognizing the different sorts of student car loans and their terms is vital for making informed economic choices. Student financings normally fall under two major categories: government and personal fundings (Cash Loans). Government finances, supplied by the government, generally supply reduced passion rates and more adaptable payment choices. Subcategories include Direct Subsidized Loans, where the federal government covers rate of interest while students remain in institution, and Direct Unsubsidized Loans, which accrue rate of interest instantlyOn the other hand, private loans are supplied by banks or various other banks, often calling for a credit rating check and possibly co-signers. These finances may have variable rate of interest and less desirable payment terms. Pupils have to additionally know car loan limitations, moratorium, and deferment alternatives, as these elements can greatly influence their economic obligations post-graduation. Recognizing these distinctions is vital for students maneuvering their instructional financing choices.

The Financial Influence of Pupil Fundings on Education And Learning

How do student car loans shape the academic landscape for striving trainees? Trainee financings greatly influence instructional gain access to and price, making it possible for several people to seek greater education and learning who could or else be incapable to do so. By giving essential financing, these finances permit trainees to cover tuition prices, costs, and living expenditures, cultivating a setting where education and learning can be prioritized.Nonetheless, the monetary worry of pupil finances can also lead to lasting implications. Graduates typically deal with significant debt, which can affect their financial stability and selections in the future. The necessity of paying back finances might trigger trainees to select institutions or programs based upon prospective wage results instead than personal enthusiasm or rate of interest. While trainee financings democratize accessibility to education, they likewise develop a complex partnership in between monetary commitment and educational quests, inevitably forming exactly how pupils navigate their academic trips.

How Trainee Fundings Impact Profession Choices

Trainee financings significantly form job decisions for numerous graduates. Monetary pressure commonly forces people to go after higher-paying tasks, which may not straighten with their passions or degree selections. Subsequently, the concern of financial debt can steer graduates towards specific fields, influencing both their prompt choices and long-lasting job trajectories.Financial Pressure on Jobs

A considerable variety of graduates deal with tremendous economic pressure due to pupil lendings, which can exceptionally form their job options. This monetary problem frequently urges people to prioritize job security and greater incomes over passion-driven occupations or personal passions. Several graduates might select roles in higher-paying fields, such as financing or innovation, also if their real interests depend on innovative or nonprofit markets. The requirement to pay back car loans can result in a feeling of necessity that stifles exploration of much less profitable however fulfilling job paths. Furthermore, this stress may cause grads to remain in work longer than desired, fearing instability if they go after modifications. Inevitably, pupil car loans can determine profession trajectories, limiting alternatives and affecting life contentment.Level Choice and Debt

What aspects drive graduates to pick details degrees in a landscape controlled by financial obligation? Many trainees prioritize areas that promise greater earning possible, seeing their degree as a financial investment to minimize the worry of trainee lendings. Job potential customers, job stability, and income assumptions significantly affect these choices, with levels in STEM fields commonly favored for their viewed economic rewards. Additionally, the increasing expenses of education and learning urge students to examine the roi, leading them to select programs with solid work positioning rates. Conversely, degrees in the arts or humanities might be ignored, in spite of their innate value, because of worries over employability and earnings. Inevitably, the interaction of financial obligations and profession aspirations shapes vital educational decisions.Managing Student Financing Debt: Strategies for Success

Steering via the intricacies of pupil financing financial debt calls for an aggressive strategy and notified decision-making. People handling trainee finance financial debt have to first comprehend their loan terms, consisting of rates of interest, repayment alternatives, and any kind of possible advantages. Producing a thorough spending plan can assist in monitoring costs and determining exactly how much can be assigned toward car loan settlements. Focusing on high-interest lendings can minimize total financial debt expenses, while making extra payments when possible can quicken payment. Registering in auto-pay might supply rates of interest reductions, and consumers must stay updated on any kind of modifications to federal lending plans or relief programs. Additionally, discovering income-driven payment strategies can use a workable payment framework based upon earnings degrees. Cultivating open communication with finance servicers can clear up any kind of confusion relating to settlement responsibilities. By executing these approaches, people can navigate their trainee car loan commitments more efficiently, leading the way for a much healthier financial future.Resources for Financial Planning and Car Loan Payment

Various sources are available to assist people in monetary preparation and funding repayment. Financial literacy programs, generally used by area organizations or instructional establishments, offer essential expertise on budgeting, saving, and taking care of student financings. Online tools, such as loan calculators, assistance borrowers estimate month-to-month payments and complete repayment expenses, permitting for informed choices.

Additionally, lots of lenders and banks offer workshops check out here focused on finance monitoring and settlement approaches. These sessions can furnish individuals with strategies to browse settlement plans successfully. Not-for-profit credit report therapy services are likewise invaluable, offering customized advice and potential financial debt monitoring alternatives.

Furthermore, federal government sites like the Federal Student Help portal provide substantial details on settlement strategies, financing mercy programs, and qualification requirements. By using these sources, people can produce a structured financial strategy, enabling them to manage their student financings while pursuing lasting monetary stability

The Duty of Scholarships and Grants in Reducing Financial Debt

Grants and scholarships play an important duty in relieving the monetary concern of education and learning, ultimately minimizing the reliance on pupil finances. These types of financial assistance offer pupils with the chance to pursue greater education without the impending risk of accumulating debt. Unlike finances, grants and scholarships do not call for repayment, making them an essential resource for many households.University, private organizations, and government firms use different scholarships and gives based on value, need, or particular criteria, such as field or group background. By protecting these funds, pupils can cover tuition, fees, and various other relevant costs, which considerably lowers their overall financial commitment. Consequently, the accessibility of scholarships and gives promotes higher accessibility to education and learning and advertises a more equitable environment for students from varied backgrounds. Inevitably, this assistance empowers students to focus on their academic and career goals without the constant fear of monetary stress.

Long-Term Effects of Student Finances on Financial Wellness

Pupil loans can greatly influence a person's economic wellness gradually. A high debt-to-income ratio may hinder Look At This future borrowing potential, while superior loans can negatively influence credit rating. Recognizing these lasting ramifications is vital for any individual passing through the complexities of student debt.Debt-to-Income Proportion Influence

The worry of pupil fundings can significantly influence a person's debt-to-income ratio, a vital metric for reviewing financial health (Payday Loans). This proportion compares regular monthly financial debt responsibilities to gross monthly income, supplying insights right into a debtor's capability to manage extra debt. High pupil finance balances can bring about elevated debt-to-income ratios, making it testing for individuals to receive home loans, auto lendings, or various other monetary products. Therefore, graduates might face troubles in achieving vital life turning points such as homeownership or beginning a company. With time, an undesirable debt-to-income proportion can impede lasting financial stability, limiting opportunities for development and investment. Consequently, managing this ratio and recognizing becomes essential for those steering the post-college monetary landscapeCredit Report Ramifications

Navigating with the complexities of credit report shows crucial for individuals carrying student funding financial debt, as these lendings can significantly shape one's monetary narrative. Student fundings play a substantial duty in establishing credit report, affecting aspects like repayment history and credit rating mix. Consistent, on-time payments contribute favorably, strengthening a person's credit score account. Missed repayments can lead to severe consequences, including a significant decline in credit score scores. Additionally, the complete amount of student financial debt can impact debt application ratios, further influencing economic health and wellness. In time, sensibly handled student financings can lead the way for far better credit history chances, such as reduced rates of interest on mortgages or credit cards. Eventually, understanding these ramifications help people in making educated economic decisions.Regularly Asked Concerns

Can Pupil Loans Affect My Debt Score?

Student financings can greatly impact an individual's credit report. Timely settlements can improve it, while missed repayments might lead to a reduction. On the whole, responsible administration of student fundings is necessary for keeping a healthy credit score account.What Happens if I Default on My Student Fundings?

Back-pedaling trainee loans can cause extreme consequences, consisting of damaged credit history, wage garnishment, and loss of qualification for economic aid. It likewise restricts future borrowing alternatives, making financial healing considerably more difficult.

Exist Funding Mercy Programs Available?

Yes, different financing mercy programs exist, including Civil service Car loan Mercy and Teacher Finance Mercy. These programs provide alleviation to consumers who satisfy particular standards, helping them minimize their pupil lending financial obligation gradually.Just how Do I Settle Numerous Pupil Car Loans?

To combine multiple student loans, a person can request a Straight Debt Consolidation Loan through the United State Division of Education, which incorporates numerous loans into one, streamlining settlements and possibly decreasing rates of interest.Can I Postpone My Trainee Lendings While in Grad College?

Yes, trainees can delay their car loans while going to graduate institution, offered they meet specific qualification requirements. This allows them to postpone settlements, allowing focused scholastic quests without the immediate financial problem of finance payment.Student lendings usually go drop into two major groups: exclusive and federal loans. People managing pupil funding debt have to first comprehend their car loan terms, including passion prices, repayment choices, and any possible advantages. High student loan equilibriums can lead to elevated debt-to-income ratios, making it testing for individuals to qualify for mortgages, cars and truck fundings, or various other financial products. Maneuvering via the complexities of credit report scores verifies important for individuals lugging student financing financial obligation, as these lendings can substantially shape one's monetary story. Yes, different lending forgiveness programs exist, consisting of Public Solution Financing Mercy and Teacher Finance Forgiveness.

Report this wiki page